VAT Domestic reverse charges for construction: What’s changed?

1st March 2021 Protean General

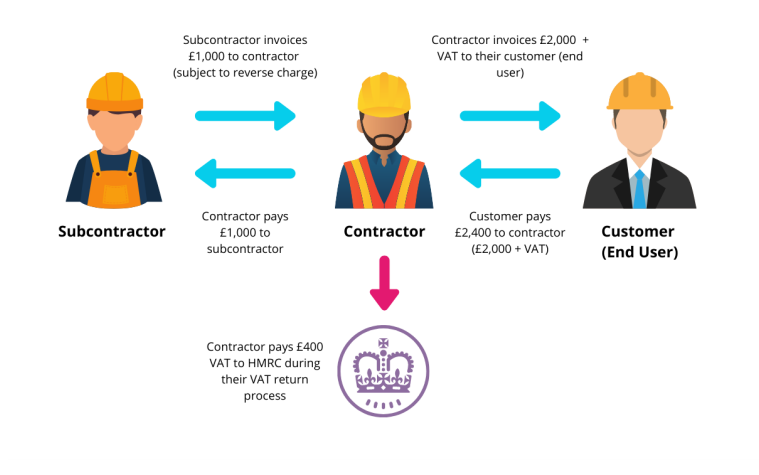

Domestic reverse charge VAT legislation is a change in the way CIS registered construction businesses handle and pay VAT.

It is being introduced in the UK on 1 March 2021, having previously been delayed from October 2019. The domestic reverse charge VAT procedure is an anti-fraud measure designed to counter sophisticated criminal attacks on the UK VAT system. It intends to cut down on “missing trader” fraud, where companies receive high net amounts of VAT from their customers but have no intention of paying the VAT to HMRC.

It affects VAT registered construction businesses that supply or receive construction and building services that are reported under the Construction Industry Scheme (CIS). It means the customer (contractor) will be responsible for the VAT due to HMRC instead of the supplier (subcontractor).

Are there any exceptions?

This would not apply to services supplied to non-VAT registered individuals or businesses. This would mean that work done for homeowners/domestic should be invoiced in the same way prior to these changes.

What does it mean for your business?

If your construction business is part of the Construction Industry Scheme you will be affected by this new legislation. It would be beneficial for you to know how it will affect your processes and business as DRC will be a mandatory requirement for the HRMC

If you are a VAT registered subcontractor (supplier) who provides building and construction services to a VAT-registered contractor (customer) who is CIS-registered then you no longer need to account for the VAT. Instead, your invoice should inform your customer that the VAT reverse charge is applied and they are responsible for the VAT using the reverse charge procedure.

If you are a VAT-registered contractor (customer) you will instead account for both input and output tax on invoices you receive from your VAT-registered subcontractors.

How Protean Software can help you

Sales

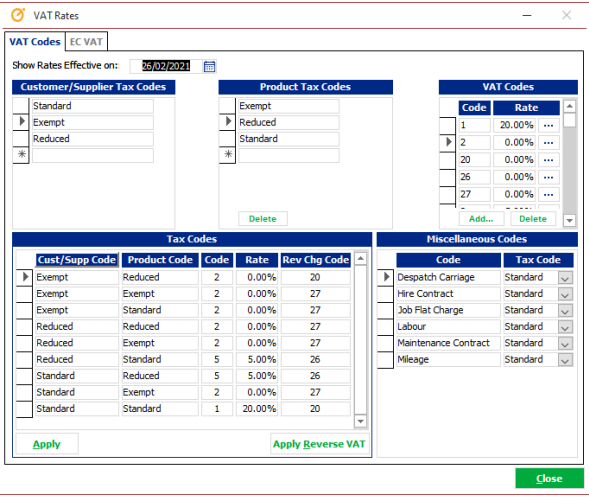

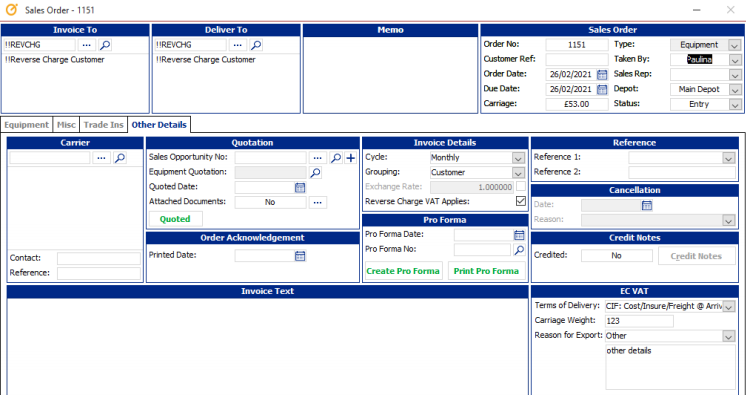

To accommodate this legislation change, a new Setting has been added called ‘Use Reverse Charge VAT’ (Y/N) that exposes the new features below. Tax Set Up

Tax Set Up

A new option has been added in the VAT Codes form to ‘link’ your ‘Reverse Charge VAT Code’ in your accounts system to a rate in Protean.

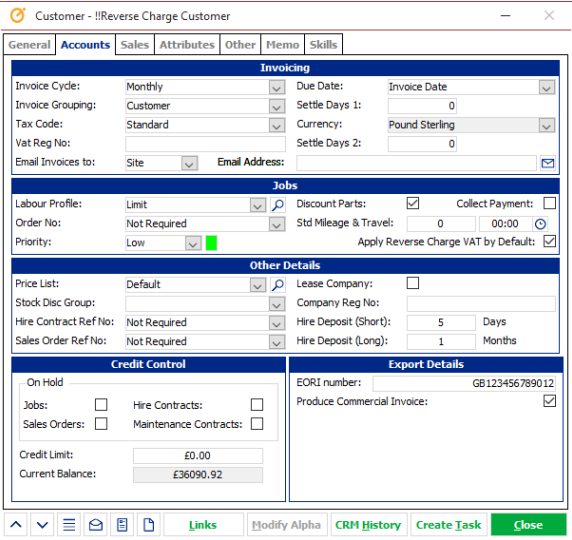

Customer

A new checkbox has also been added to the Accounts Tab (Jobs section) on the Customer record called ‘Reverse Charge VAT’ that users can manually tick/untick on a customer-by-customer basis. The default is unticked. This will act as a default value for any jobs created for this customer

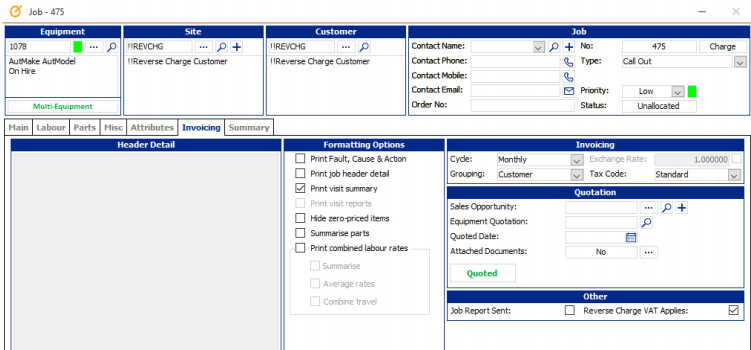

Similarly, a new checkbox has been added to Invoicing Tab on the Job form called ‘Reverse Charge VAT Applies’ that users can manually tick/untick on a job-by-job basis. This is defaulted from the Customer (as discussed above)

Similar checkboxes are also in place on Sales Orders, Hire Contracts & Hire Extras

When invoicing a Job, Sales Order or Contract flagged in this way:

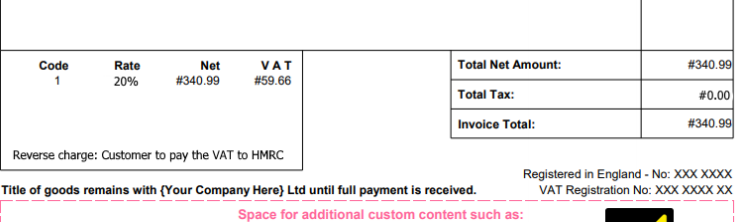

• A label appears on the invoice under the VAT breakdown stating “Reverse charge: Customer to pay the VAT to HMRC”

• Invoice layout shows the VAT rate & values as normal but they are not included in the invoice total

• The output to the Accounts System uses the new ‘Rev Chg Code’ specified in Tax Codes (above) for this invoice & VAT value would be £0.

Purchases

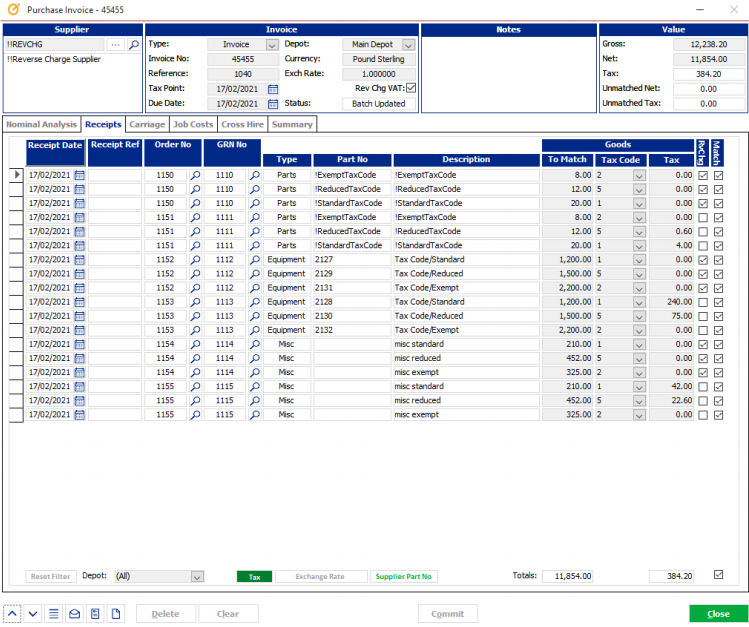

A new checkbox has been added to the Accounts Tab on the Supplier record called ‘Reverse Charge VAT’. The default behaviour is unchecked. This is to act as a default value and be inherited down to any Purchase Invoices entered for this Supplier.

On a Purchase Invoice we have added a checkbox to the header called ‘Reverse Charge VAT Applies’ which is defaulted from the Supplier option. (to act as default for this invoice but can be changed per line item) A new checkbox has been added under the ‘Tax’ button view on each line of the Purchase Invoice Matching screen so that individual elements of an invoice can be flagged/unflagged as falling under this rule as needed.

If a line or whole invoice is checked by the user then when output to an accounts system:

• Input VAT remains at the normal rates and input accounting remains as it currently is. Page 8 of 9

• Additionally, the same amount of tax is to be included in Output VAT (ie the sales side of the VAT return), so the net effect is zero.

Write a Comment